Making Our Nation

Work for the Many,

Not the Few.

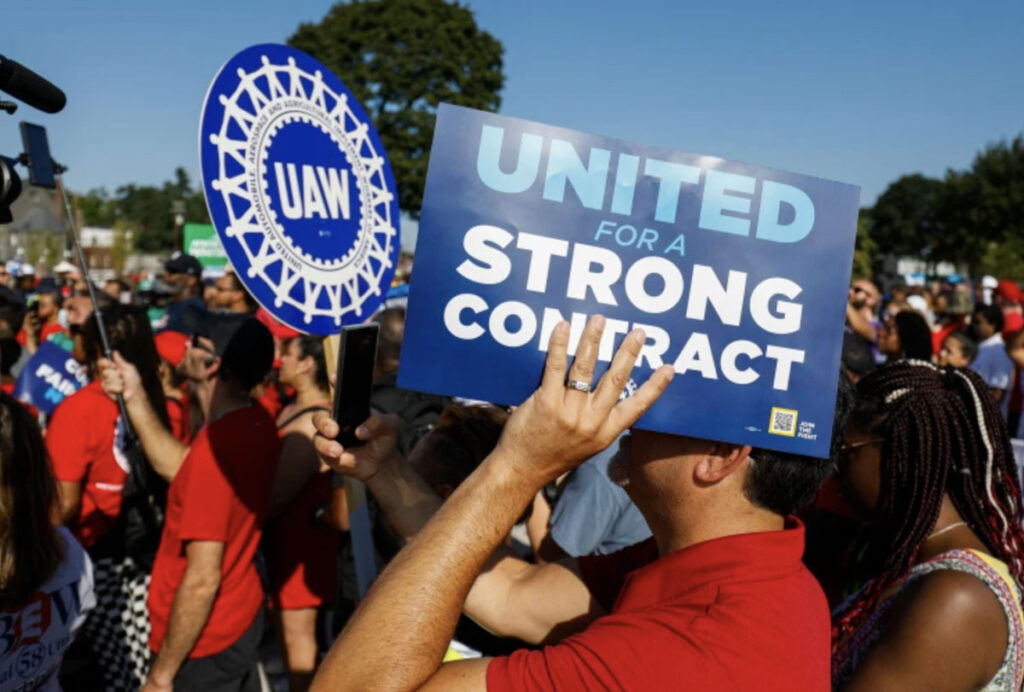

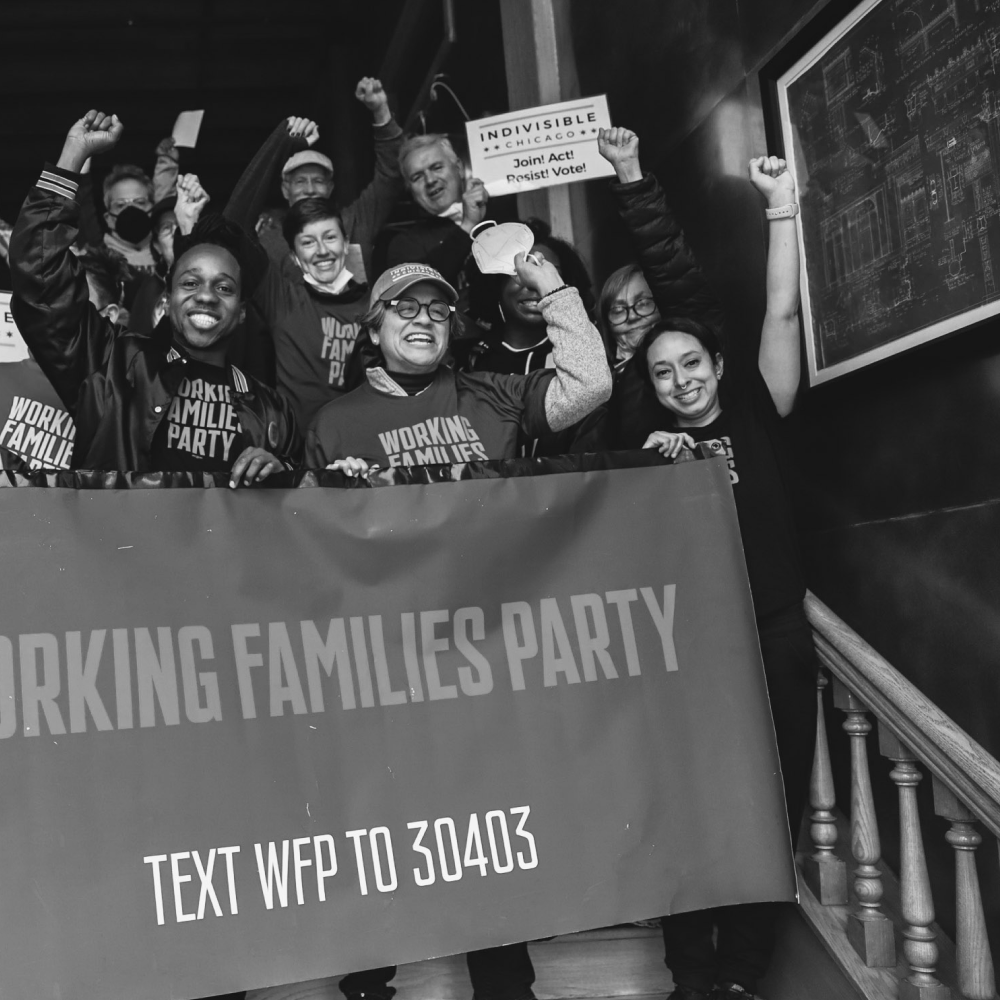

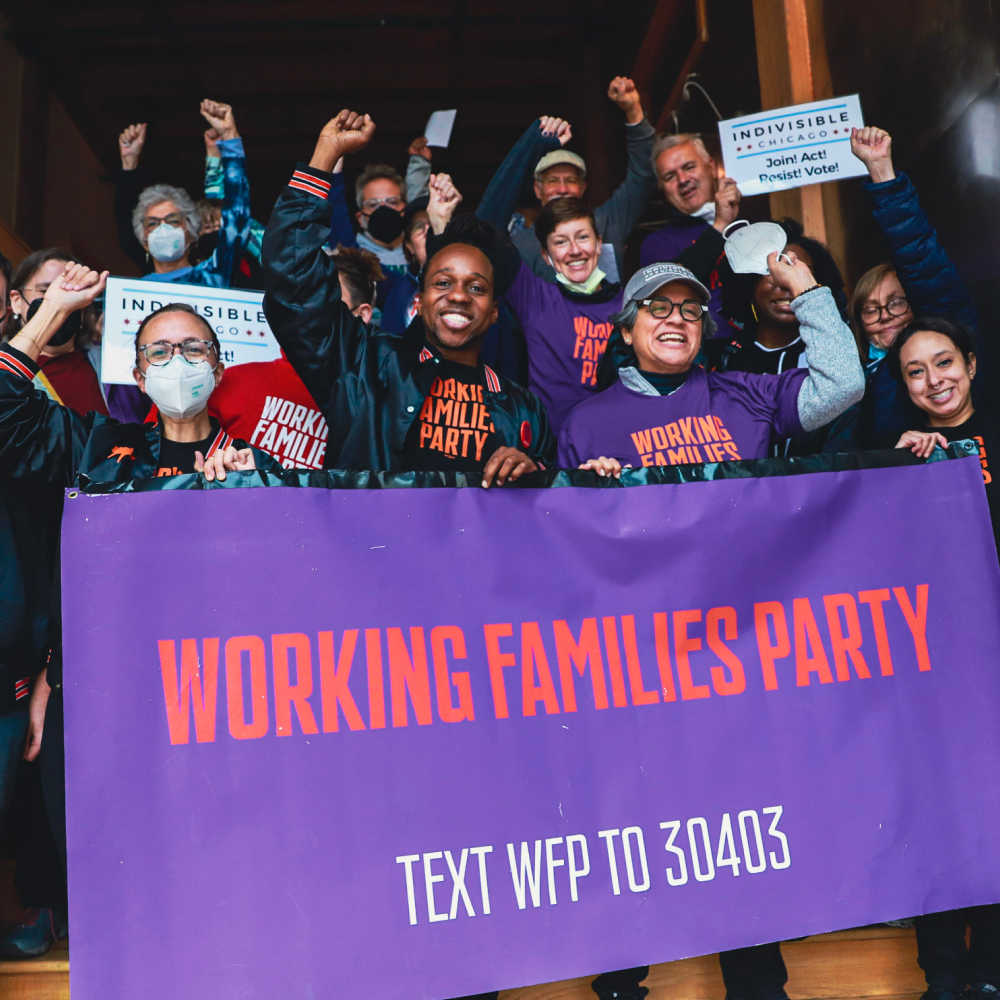

We’re building a multiracial party of working people to transform our country.

State by state and community by community, WFP is building a political home for all of us who see bigotry, bailouts, and business as usual in our political system and ask, “Is that the best we can do?”